Brad Jacobs: WSJ Profile Takeaways

The serial entrepreneur reveals some interesting facts in an interview with the WSJ

Brad Jacobs was most recently in the news as the man behind the hostile takeover of Beacon Roofing Supply. But he has a long history of identifying profitable industries and creating giants in those sectors, usually taking the companies public.

In an effort to seem less hostile to the public, he’s been on a bit of a media tour with a profile in the Wall Street Journal entitled, “Meet the Takeover King Who Leans on Yoga and Team Bonding to Make Billions.” If you’d never heard of Brad Jacobs before reading about the Beacon Roofing Supply takeover, as I had never heard of him, then you might imagine a sort of aggressive person behind business. But he presents a softer side - he has an affinity for yoga and meditation - in this WSJ profile.

Here are some interesting facts he shared:

His companies - named QXO, XPO Logistics, GXO, and RXO (as well as United Rentals, although it doesn’t fit the pattern) - use the “X” and “O” as “hugs and kisses.” The WSJ notes that he’s joking when he says this, but the naming convention is unusual and a little confusing.

He dropped out of college; he studied mathematics and music while enrolled.

He is basically a regular when it comes to ringing the bell at the New York Stock Exchange: “Jacobs has now rung the bell at the New York Stock Exchange 10 times, second most according to records.” His history of combining companies and then also spinning companies off when it seems strategic has brought him up to the stage many times. The profile, while detailed, did not note who has rung the bell the most.

When he is doing a takeover of another company - a key part of his approach at prior companies he’s started (referred to sometimes as a “roll-up” strategy) - he wants to talk to employees as soon as possible: “In many M&A deals, buyers don’t have much access to the seller’s workforce until the transaction closes. Jacobs says he negotiates into his contracts the ability to communicate with staff right after a deal is signed.” This approach when paired with his reportedly calm demeanor and emphasis on teambuilding exercises seems to endear him to employees, many of whom are likely wary of the incoming takeover specialist.

He started out his career with a “simple” ambition: “…in the 1970s, Jacobs envisioned a simpler future. ‘I wanted to make $100,000…I figured I’d be able to live off of that, just meditate and do music and enjoy life,’ he said.” This drive led to him founding two consecutive oil brokerage firms, the latter of which he scaled up to $1 billion in annual revenue. So much for playing music and meditating (though the article mentions that he still meditates - part of his calm approach to dealmaking).

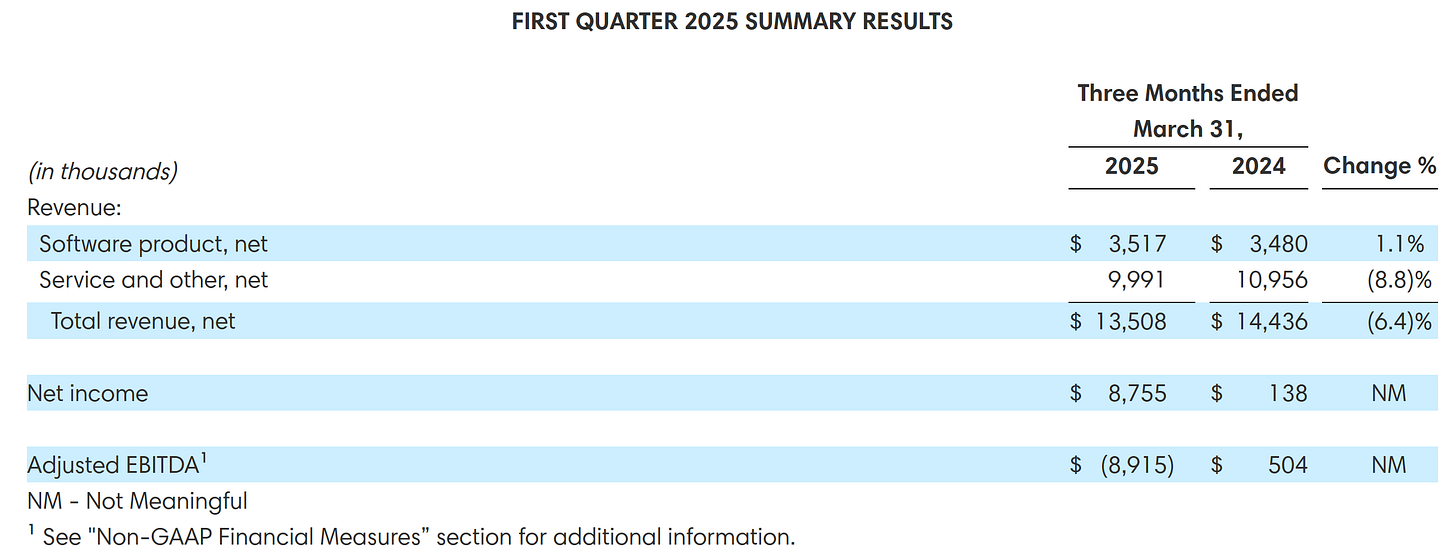

His ambition to scale up Beacon Roofing Supply to $50 billion in annual revenue seems audacious and hard to believe. But he’s proven his ability to consolidate within industries and create companies with enduring value: the companies in which he has had a hand in forming over the years have market capitalizations totaling well into the tens of billions in aggregate - United Rentals has a market cap of $45 billion - so he seems to have the skills for the job. QXO released its first results following its acquisition of Beacon Roofing Supply earlier this month. The company reported quarterly revenue of $13.5 million which shows that the so-called “Takeover King” and his newest company have a long road ahead.